DEBT ASSIGNMENT AND ASSUMPTION AGREEMENT

How does it work?

1. Choose this template

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

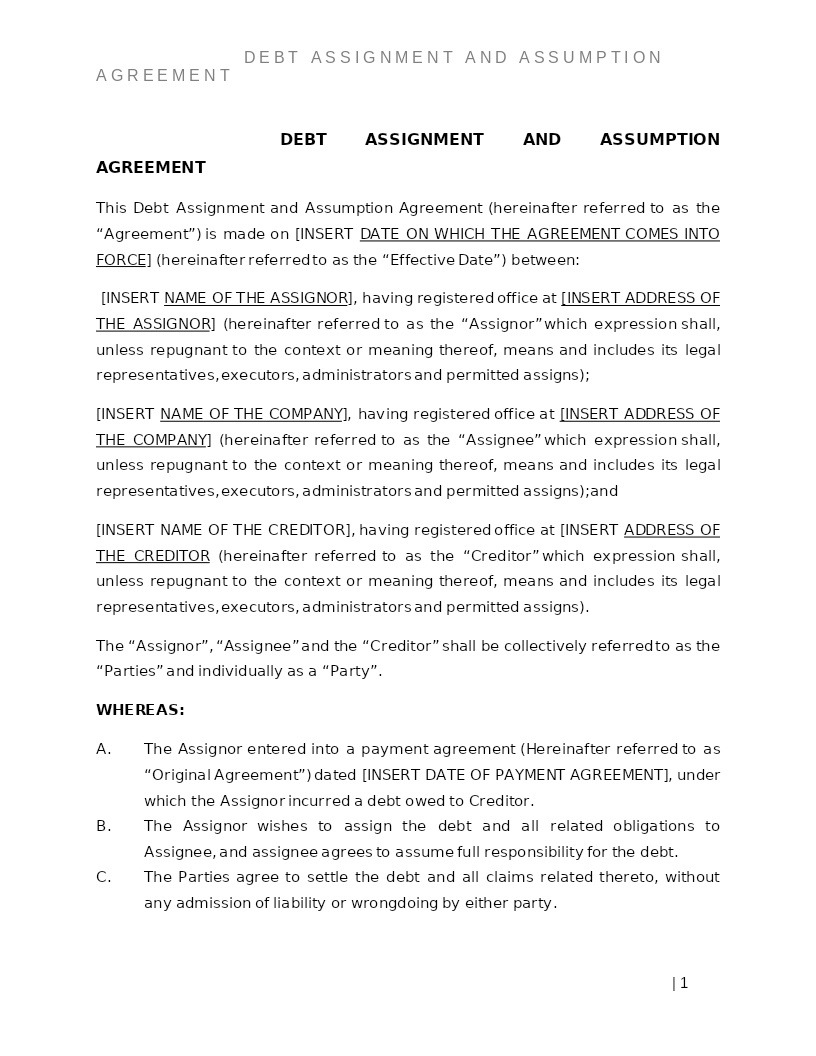

Understanding Debt Assignment and Assumption Agreements

When a debt obligation needs to be transferred from one party to another, clarity and legal structure become essential. A Debt Assignment and Assumption Agreement provides that framework. It defines how an existing debt is assigned, what the new party (the “Assignee”) is agreeing to take over, and how the original party (the “Assignor”) is released or partially released from liability.

This agreement allows all parties, including the creditor, to understand who is responsible for repayment, how the transfer occurs, and what rights or obligations follow the debt after assignment. It minimizes confusion, prevents disputes, and ensures a clean and legally recognized transition of financial obligations.

Where Debt Assignment and Assumption Agreements Are Commonly Used

Debt transfers occur in many personal and commercial transactions, including:

- Buying or selling a business that carries outstanding liabilities

- Reassigning personal loans or private lending arrangements

- Real estate financing, landlord, tenant debt transfers, or HOA obligations

- Partner buyouts or restructuring within companies

- Consolidation or reallocation of debts among related parties

- Investment transactions involving loan portfolios or promissory notes

Whenever financial responsibility needs to pass from one party to another, this agreement provides a clear and enforceable process.

Different Types of Debt Transfers You May Encounter

- Full Debt Assignment: The entire debt is transferred, and the Assignee becomes solely responsible.

- Partial Debt Assignment: Only a portion of the debt is transferred, allowing multiple responsible parties.

- Secured Debt Assignment: Used when collateral (such as property, vehicles, or business assets) is linked to the debt.

- Unsecured Debt Assignment: Applied when the debt has no collateral and is based on trust or contractual promise.

- Structured Debt Transfer: Used when payments, interest terms, or maturity dates are revised during the assignment.

When Legal Guidance Becomes Helpful

Most simple debt transfers can be performed using a template, but legal support is valuable when:

- The creditor must approve the assignment

- The debt includes collateral, liens, or security interests

- Multiple parties or entities are involved in the transfer

- The loan is tied to a business acquisition or restructuring

- The parties want to modify interest rates, terms, or repayment schedules

- State-specific lending or collection laws apply

- The Assignor wants a full legal release from future liability

Legal review reduces risk and ensures the assignment is enforceable under U.S. commercial and contract law.

How to Work with This Template

- Identify the Assignor, Assignee, and Creditor

- Define the debt being transferred with clear reference details

- Specify the amount owed, payment terms, and any accrued interest

- Describe whether the Assignor is released from liability

- Include rights, warranties, and obligations of both parties

- Choose governing state law

- Sign electronically or in hard copy

This template aligns with common U.S. lending, credit, and contract practices and is compatible with all major e-signature platforms.

Frequently Asked Questions

Q1. What is a Debt Assignment and Assumption Agreement?

It is a legal document that transfers an existing debt from one party to another. The Assignee accepts full or partial responsibility for repayment, while the Assignor may be released from ongoing liability. It ensures that all parties, including the creditor clearly understand who is responsible for the obligation.

Q2. Does the creditor need to approve the assignment?

Often, yes. Many loans or financial contracts require the creditor’s consent before a debt can be transferred. Without approval, the transfer may not be valid, or the Assignor may remain legally responsible for the debt.

Q3. Can this agreement completely release the original debtor?

Yes, but only if the creditor explicitly provides a release. Some assignments leave the Assignor secondarily liable if the Assignee fails to pay. The agreement must clearly specify whether the release is full, partial, or not granted at all.

Q4. Is a Debt Assignment Agreement enforceable in all U.S. states?

Yes. Debt assignments are generally enforceable under U.S. contract and commercial laws, provided they meet state requirements, include all essential terms, and receive creditor approval when needed.

Q5. Can secured debts be transferred?

They can, but transferring a debt tied to collateral, like a house, car, or business asset may require additional documentation, filing, or lender approval. The security interest must be properly reassigned to avoid gaps in protection.

Q6. Does assigning a debt change the interest rate or repayment terms?

Not automatically. The assignment only transfers responsibility unless the creditor and parties agree to modify terms. Any changes to interest, payment schedule, or maturity should be documented in writing.

Q7. Can businesses use this agreement during acquisitions?

Absolutely. Debt transfers are common during mergers, asset purchases, or partner buyouts. The agreement ensures that liabilities move to the proper party as ownership changes.

Q8. What happens if the Assignee fails to pay?

Depending on the agreement, the creditor may pursue the Assignee and potentially the Assignor if no release was granted. Clearly defining liability is essential to avoiding unexpected future obligations.

Q9. Are electronic signatures valid for debt assignment agreements?

Yes. Under the U.S. ESIGN Act, electronically signed agreements are fully enforceable, making it easy to complete assignments remotely and securely.

Q10. Is this agreement useful for personal loans between family or friends?

Definitely. Personal debts often get reassigned or consolidated, and a written agreement prevents misunderstandings, protects relationships, and documents financial responsibility clearly.