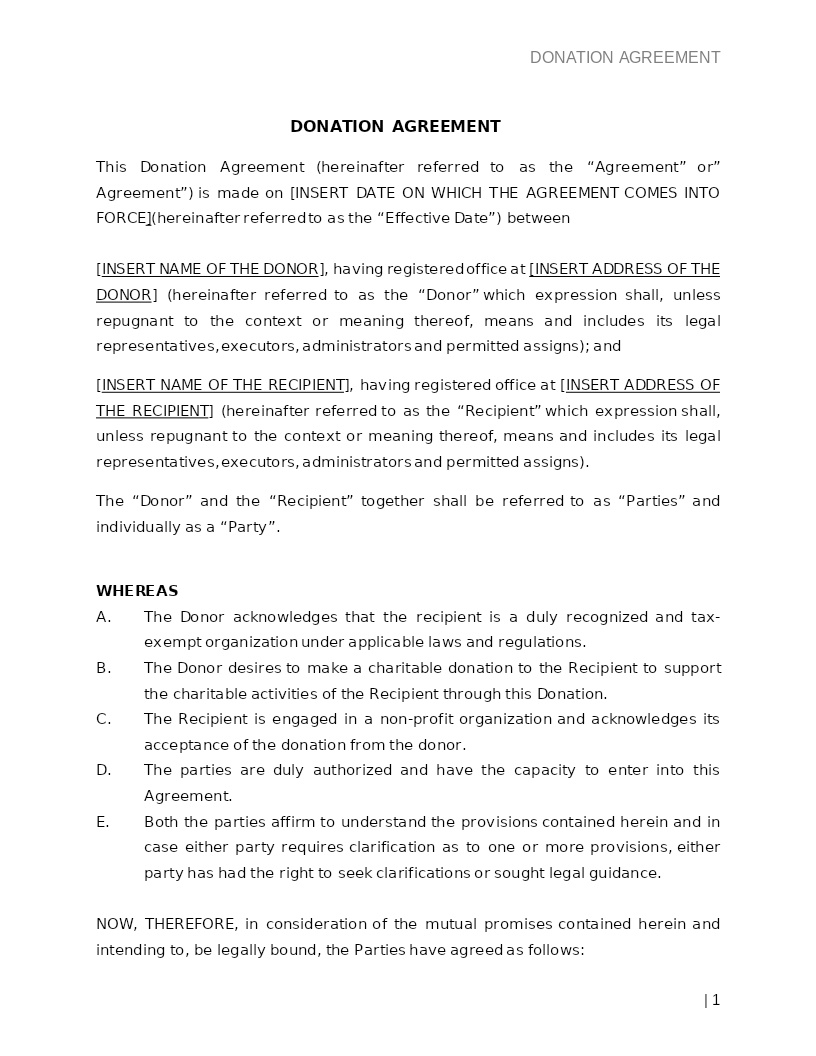

DONATION AGREEMENT

How does it work?

1. Choose this template

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Understanding Donation Agreements

A Donation Agreement is a legally binding contract that outlines the terms and conditions under which a donor gives money, property, or other assets to a nonprofit organization, charity, educational institution, or individual beneficiary. The agreement helps clarify donor intent, restrictions on the gift, payment schedules, reporting responsibilities, and acknowledgment requirements.

In the United States, Donation Agreements operate under state contract laws, federal IRS regulations, charitable solicitation laws, nonprofit governance rules, and gift tax guidelines. They protect both the donor and recipient by documenting the purpose of the donation and ensuring the funds or assets are used as intended.

Donation Agreements are commonly used for large gifts, restricted donations, endowments, scholarship funds, building contributions, or any donation where clarity and accountability are important.

Where Donation Agreements Are Commonly Used

Donation Agreements are widely utilized across charitable and nonprofit sectors, including:

- Nonprofits accepting major gifts or pledged contributions

- Universities and schools establishing scholarships or research funds

- Hospitals receiving donations for medical equipment or facility construction

- Charities accepting restricted donations or project-based funding

- Religious organizations receiving contributions for specific missions or programs

- Foundations transferring grants to partner organizations

- Donors making one-time or recurring contributions with reporting requirements

Whenever a donation involves significant value or a specific purpose, a Donation Agreement ensures transparency, recordkeeping, and compliance with U.S. charitable regulations.

Different Types of Donations You May Encounter

- Cash Donations: One-time or recurring monetary contributions made directly to the recipient.

- Pledged Donations: Commitments to give money or assets over time, typically with a payment schedule.

- Restricted Donations: Funds designated for a specific program, initiative, department, or mission. The recipient must use the donation according to the stated purpose.

- Unrestricted Donations: Funds the organization can use at its discretion to support general operations.

- Non-Cash Donations: In-kind gifts such as property, equipment, vehicles, art, securities, or intellectual property.

- Endowment or Legacy Gifts: Long-term investments or estate-based contributions that support ongoing programs or future needs.

When Legal Guidance Becomes Helpful

Legal review is recommended when:

- A donation includes restrictions or special conditions the recipient must follow

- The donor contributes real estate, securities, or intellectual property

- The agreement involves multi-year pledges or complex payment schedules

- The organization is subject to IRS reporting requirements or state charitable solicitation laws

- The donor requires naming rights, acknowledgments, or public recognition

- The donation may trigger tax implications, including gift tax or charitable deductions

- The parties want clarity on return of funds, misuse remedies, or termination rights

Legal guidance protects both donor intent and organizational compliance with federal and state regulations.

How to Work with This Template

- Identify the donor and the recipient organization or individual

- Describe the type and value of the donation (cash, property, services, etc.)

- Specify donor restrictions, intended purpose, and reporting requirements

- Outline payment methods, schedules, and acknowledgment obligations

- Include tax-compliance language for both donor and nonprofit

- Choose the governing U.S. state law

- Add conditions for return of donation, project failure, or non-compliance

- Include confidentiality, publicity, or naming rights (if applicable)

- Sign electronically or in hard copy

This template is compatible with leading U.S. e-signature platforms and follows standard practices in nonprofit and charitable giving agreements.

Frequently Asked Questions

Q1. What is a Donation Agreement and why is it important?

Ans. A Donation Agreement is a written contract documenting the details of a contribution made to a nonprofit or beneficiary. It ensures the donation is used as intended, provides legal clarity for both parties, and helps the donor maintain accurate records for tax deductions and compliance.

Q2. Are Donation Agreements legally enforceable in the U.S.?

Ans. Yes. Donation Agreements are enforceable under state contract law when they clearly outline the donor’s intent, the amount or asset being donated, and any restrictions. Courts often enforce these agreements, especially when nonprofits rely on pledged contributions for long-term planning.

Q3. Can a Donation Agreement include restrictions on how the funds are used?

Ans. Absolutely. Donors can designate contributions for specific programs or purposes, such as scholarships, research, construction, or community initiatives. The agreement clearly states these restrictions, and the recipient is legally obligated to follow them.

Q4. Are donations tax-deductible?

Ans. In many cases, yes. Donations to qualified 501(c)(3) nonprofits may be tax-deductible under IRS rules. A Donation Agreement helps document the contribution, but donors should also receive an official acknowledgment letter for tax reporting. Always consult a tax professional for guidance.

Q5. Can a donor cancel or modify a pledged donation?

Ans. It depends on the agreement terms. Some Donation Agreements allow modifications due to financial hardship, while others treat pledges as binding commitments. Terms regarding cancellation, modifications, or delays should be clearly written in the contract.

Q6. How are non-cash or in-kind donations handled?

Ans. Non-cash gifts, such as real estate, securities, or equipment require additional documentation, valuation, and sometimes IRS forms (like Form 8283). The agreement outlines the nature of the asset, its estimated value, and any transfer requirements.

Q7. Can a nonprofit return a donation?

Ans. Yes, but only in specific situations. Donations may be returned if the intended purpose cannot be fulfilled, if restrictions are impossible to meet, or if required by state charitable laws. The agreement may include a clause explaining how funds are handled if the project ends or changes.

Q8. Are electronic signatures valid for Donation Agreements?

Ans. Yes. Under the U.S. ESIGN Act, electronic signatures are legally valid and enforceable. Most nonprofits and donors use e-signature platforms like Docu Sign to execute Donation Agreements efficiently.

Q9. Can a Donation Agreement include naming rights?

Ans. Yes. Many major gifts include recognition rights, such as naming a building, room, scholarship, or program. The agreement outlines the duration, terms, and conditions for naming rights, including circumstances under which they may be modified or revoked.

Q10. Is a Donation Agreement suitable for small contributions?

Ans. Donation Agreements are most commonly used for significant or restricted gifts. For small, one-time donations, a simple receipt or acknowledgment may be sufficient. However, businesses and high-value donors often prefer written agreements for transparency and tax compliance.