INCOME VERIFICATION LETTER

How does it work?

1. Choose this template

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Providing Reliable Income Confirmation for Financial, Housing, and Employment Requirements in the United States

When an individual needs to demonstrate their financial stability—whether for renting a home, applying for a loan, or qualifying for government benefits—it's essential to provide a formal document that verifies their income. An Income Verification Letter offers that structure. It confirms employment status, salary or wages, and any additional compensation in a clear and official format.

Having an Income Verification Letter ensures transparency, supports financial evaluations by lenders or landlords, and provides verified proof of income for legal, administrative, or professional purposes. It helps organizations assess the applicant’s financial reliability with confidence.

Where Income Verification Letters Are Commonly Used

Income verification is routinely required in a wide range of situations, including:

- Rental applications for apartments, houses, or commercial spaces

- Loan or mortgage applications with banks or credit unions

- Applications for credit cards, financing plans, or installment agreements

- Government aid programs such as housing benefits or financial assistance

- Child support, divorce, or court proceedings requiring income confirmation

- Employment changes, job transitions, or internal HR verification requests

Any time someone must prove their earnings, an income verification letter provides official and reliable documentation.

Different Types of Income Verification Letters You May Encounter

- Employer-Issued Income Verification: Confirms salary, employment status, and duration of employment.

- Self-Employment Income Verification: Uses financial statements, tax returns, or accountant letters for freelancers or business owners.

- Government or Agency Verification Letters: Used for social security benefits, disability income, or public assistance.

- Third-Party Verification Letters: Issued by payroll companies, HR departments, or financial institutions.

When Legal Guidance Becomes Helpful

While most income verification letters are straightforward, legal guidance is beneficial when:

- Verification is required for court cases, child support, or legal disputes

- Income details must comply with privacy laws or workplace regulations

- The individual has multiple income sources or complex compensation structures

- Verification is tied to tax filings, audits, or regulated financial disclosures

- There are concerns about misrepresentation, fraud, or potential liability

- Employers must comply with state-specific employment documentation laws

Legal review ensures the information is accurate, compliant, and suitable for its intended use.

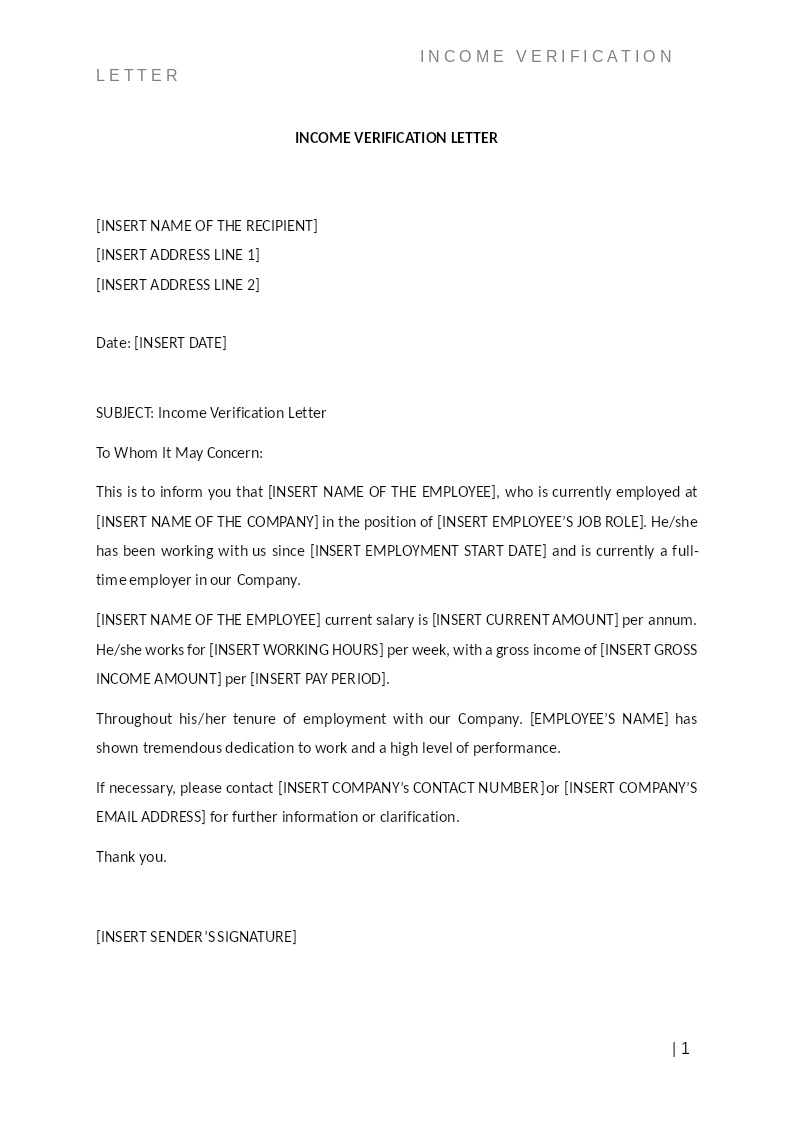

How to Work with This Template

- Identify the issuer (employer, payroll department, or authorized entity)

- Specify the employee’s name, job title, and verification details

- Clearly state salary, hourly rate, bonuses, or additional income

- Include employment duration and contact information for verification

- Review the details carefully to ensure accuracy

- Provide the letter on official letterhead and sign electronically or in print

This template follows documentation standards widely recognized by lenders, landlords, and institutions across the United States.

Frequently Asked Questions

Q1. Why is an Income Verification Letter important?

It provides verified proof of income that lenders, landlords, and agencies rely on when evaluating financial qualifications. The letter helps confirm the applicant’s ability to make payments or meet financial commitments. It also protects both parties by offering documented, official information. Without verification, many applications may be delayed or denied.

Q2. Who can issue an Income Verification Letter?

Typically, employers, HR departments, payroll companies, accountants, or government agencies can issue these letters. The issuer must be someone authorized to confirm income details. Freelancers and self-employed individuals may use tax documents or accountant letters. The credibility of the issuer strengthens the verification.

Q3. What information should be included in an Income Verification Letter?

A strong letter includes the individual’s name, job title, income amount, pay frequency, and employment status. It may also list bonuses, commissions, or contract income. Contact details for verification help institutions validate the information. The letter should be signed and provided on official letterhead.

Q4. Can an Income Verification Letter be used for loan or mortgage applications?

Yes. Lenders often rely on these letters to assess financial stability and repayment ability. The letter supplements other documents like tax returns or bank statements. Clear income verification strengthens loan applications and speeds up approval processes. It is a standard requirement in U.S. lending practices.

Q5. Is an Income Verification Letter required for rental applications?

Most landlords require proof of income to ensure that tenants can afford rent payments. The letter helps landlords evaluate financial reliability and reduces risk. It may be used alongside pay stubs or bank statements. A clear, accurate letter increases the chance of approval.

Q6. Can self-employed individuals provide income verification?

Yes. Self-employed individuals can provide tax returns, profit-and-loss statements, 1099 forms, or letters from certified accountants. These documents act as income verification when no employer is involved. Clear documentation helps institutions validate self-employment earnings. This is common for freelancers and business owners.

Q7. Is an Income Verification Letter legally binding?

While not a contract, the letter must contain accurate and truthful information. Employers or issuers can face consequences for misrepresentation. Institutions rely on the letter for financial decisions, so accuracy is essential. The letter becomes part of official application records.

Q8. Are electronic signatures acceptable on Income Verification Letters?

Yes. Most U.S. institutions accept electronically signed letters if issued on official letterhead. Federal and state laws recognize e-signatures as valid and enforceable. Digital verification also speeds up application processing. However, some agencies may require additional supporting documents for full verification.